26/04/2021

We reported last year on a new report from the European Patent Office (EPO) on electricity storage, in particular using batteries. Excluded from that report was hydrogen and its use in electricity storage, which is seen by some as a very useful supplement to batteries, not just in electricity storage but also for applications where batteries may not be appropriate, such as some transport applications.

For example, the first commercially-available hydrogen powered car was launched by Hyundai in 2013. In September 2020, HydroFLEX became the first hydrogen powered train to run on UK main line tracks. Recently, there have also been reports of the world’s first liquid hydrogen powered ferry, JCB testing the world’s first hydrogen powered digger, and the first passenger flight in a commercial-grade plane powered by a hydrogen fuel cell. Others have put claim to these, or similar, hydrogen-powered transportation milestones.

But while developments in better hydrogen fuel cells and hydrogen-powered vehicles are fascinating, this begs a question: where is all the hydrogen coming from?

Hydrogen generation

For hydrogen-powered vehicles to be an environmentally-friendly alternative to vehicles powered by internal combustion engines, the hydrogen required to run them must be produced in environmentally-friendly ways. To do this, the UK government’s recent ten point plan for a green Industrial Revolution set out building up hydrogen generation capacity as one of its ten aims. Clean hydrogen generation was also a topic at this year’s CERAweek conference.

Currently, most hydrogen is produced from fossil fuel, most commonly via steam (methane) reforming, which is energy intensive. Hydrogen produced by steam reforming is often referred to as “grey hydrogen” because of the potential environmental impact of its production. This is because the chemical reaction of methane to carbon monoxide and hydrogen is strongly endothermic, i.e. it requires the absorption of energy:

More hydrogen may then be generated using the, moderately exothermic, water-gas shift reaction:

As such, production of “grey hydrogen” requires both energy, and produces carbon dioxide.

However, there are alternative, more environmentally-friendly, ways of producing hydrogen. Two of these have received particular attention: “blue hydrogen” and “green hydrogen”.

“Blue hydrogen”, like “grey hydrogen”, is produced by steam reforming, however, the carbon dioxide is captured and stored rather than being released into the atmosphere. “Green hydrogen” is produced by electrolysis of water using renewable energy. As hydrogen can be stored, distributed, and used away from the site of production, ideally, “green hydrogen” may be generated using excess renewable energy when electricity demand is relatively low (e.g. at night) and renewable electricity generation is high (e.g. the sun is shining). “Green hydrogen” may then be used to supplement energy provision when electricity demand is relatively high, or where fossil fuels would traditionally be used.

Patents for hydrogen production

Research and development in hydrogen production has been ongoing for decades. However, research and development appears to have picked up recently. In the past ten years, the number of patent families related to hydrogen generation has increased, especially in the last couple of years, coinciding with a renewed push to mitigate the climate crisis, and a corresponding increase in funding.

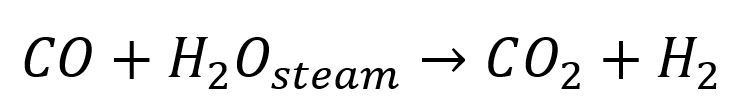

Looking at three IPC classification codes relevant to grey and blue hydrogen, C01B3/00 (Hydrogen; separation of hydrogen from mixtures containing it); C01B3/02 (Production of hydrogen or of gaseous mixtures containing hydrogen); and C01B 3/38 (Production of hydrogen using catalysts), after a small dip in patent families being published in the middle of the last decade, new records for the number of patent families published were set for each of the IPC classes in 2020 (see Figure 1a)

Figure 1: a) Patent application families published per year in three IPC classes related to hydrogen production. b) Patent application families published per year in IPC class C25B1/04, related to green hydrogen production.

More significantly, in IPC class C25B1/04 (electrolytic production of hydrogen or oxygen by electrolysis of water), which is relevant to the generation of green hydrogen, patent application families published per year have increased significantly and continually, from 279 in 2011, to 2218 in 2020 (see Figure 1b). That is an eightfold increase in a decade – and most of the increase has come more recently from 2016 to 2020.

So who is filing all these patent applications?

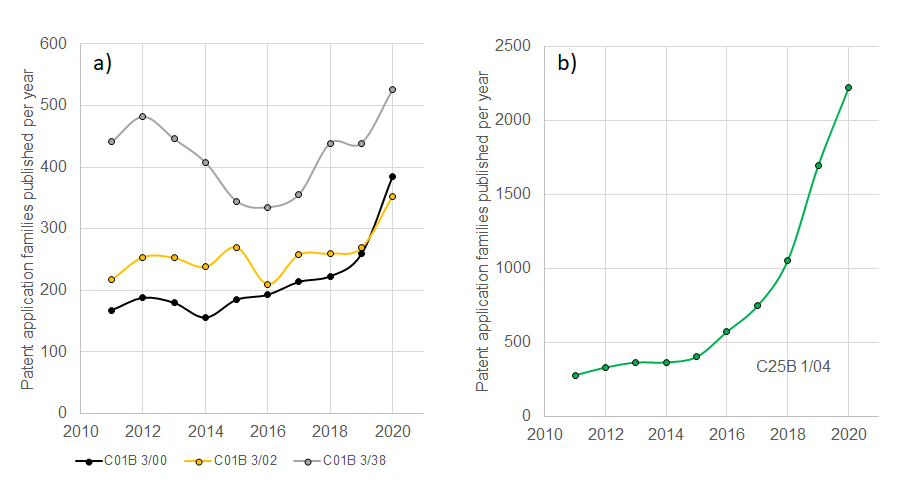

Looking at patent filings in green hydrogen (IPC class C25B1/04) in more detail, six of the ten largest filers of patent application families in the past decade are Chinese universities, including the largest filers University Shaanxi Science & Technology and University Tianjin, indicating that a lot of the research and development (and related commercialisation and licensing) is based on academic research. Some other large filers include European and Japanese companies and research organisations with a well-established interest in sustainable technologies, including Toshiba, CEA, Siemens and Honda.

However, interestingly, when looking at the number of patent applications, i.e. counting each patent application in a patent family individually, the picture changes: the largest filers are mostly companies, not universities, including the Danish catalysis company Haldor Topsoe, Toshiba, and Siemens.

Figure 2: a) Patent application families published (2011-2020) per proprietor, and b) patent applications published (2011-2020) per proprietor, in IPC class C25B1/04, related to green hydrogen production.

This suggests that a lot of the patent applications from Chinese universities are not (or at least not yet) extended to further countries, and may be Chinese applications only. The Japanese and European companies and research organisations, on the other hand, appear to seek protection in at least a few jurisdictions for most of their patent families.

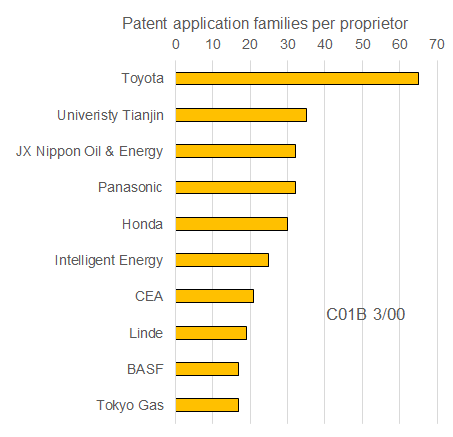

Looking at IPC class C01B3/00 as representative of research and development in grey and blue hydrogen, it is apparent that large Japanese, Korean, and European actors, such as Toyota, Panasonic, and CEA, are the largest filers of patent application families (see Figure 3). However, University Tianjin, which is the second largest filer related to green hydrogen, is also the second largest filer in this IPC class.

Figure 3: Patent application families published per proprietor in IPC class C01B 3/00, related to grey and blue hydrogen generation.

What does this tell us about the future of hydrogen generation?

It is clear that hydrogen production, and in particular green hydrogen production, is an area of significant, and increasing, research and development activity. While patent filing numbers can never tell the whole story, in particular considering the 18-month lag between filing of a patent application and its publication, it seems clear that Chinese universities, as well as Japanese and European companies and research organisations such as Toshiba, CEA, and Haldor Topsoe, are in a good position to take advantage of the desired switch to more, and greener, hydrogen.

While hydrogen generation is only one aspect in the development of a hydrogen economy, it is important to consider that the hydrogen supply chain is complex. Protecting your intellectual property at various stages of this supply chain, be it related to the generation, storage, use, or transportation, is essential. Judging by the patent data shown above, Chinese universities, and Japanese and European companies and research organisations, seem to be leading the way, in particular when it comes to green hydrogen production.

In Europe, the European Clean Hydrogen Alliance is being used to kick-start research on renewable hydrogen production by streamlining investments of an estimated €430 billion until 2030. As stated above, the UK has recently named building up hydrogen generation capacity as one of the ten aims for a green Industrial Revolution, which will be supported by government funding.

At Reddie & Grose, our experts can advise you on the best ways to protect your intellectual property related to the hydrogen supply chain, whether you work on green, blue, or grey hydrogen.

This article is for general information only. Its content is not a statement of the law on any subject and does not constitute advice. Please contact Reddie & Grose LLP for advice before taking any action in reliance on it