16/12/2019

HMRC (the department of the UK government responsible for the collection of taxes) has released a report with updated statistics on the uptake of the Patent Box, showing that the value of tax relief claimed under the Patent Box continues to increase year on year, with over £1 billion of tax relief claimed by companies.

The Patent Box is a tax relief scheme started by the UK government. The Patent Box lets companies pay a lower rate of Corporation Tax of 10% on profits derived from qualifying patented inventions. Tax relief under the Patent Box was phased in from 1 April 2013 and the full lower tax rate of 10% has been available to participants since 1 April 2017. This compares to a normal Corporation Tax rate of 19% in the UK.

The UK government introduced the Patent Box in the Finance Act 2012 with the aim to provide an incentive for companies to increase the level of patenting of intellectual property (IP) developed in the UK, and to locate the high-value jobs associated with the development, manufacture and exploitation of patents in the UK. Other countries, such as Belgium, Luxembourg and the Netherlands, already operated similar tax relief schemes.

In 2016, the UK government made changes to the Patent Box to comply with recommendations set out by the Organisation for Economic Co-operation and Development. The changes reworked the Patent Box to restrict tax relief to profits generated from IP that was initially developed in the UK, rather than profits generated from IP that was developed elsewhere. These changes were designed to appease concerns of increased tax avoidance by multinationals through use of base erosion and profit shifting.

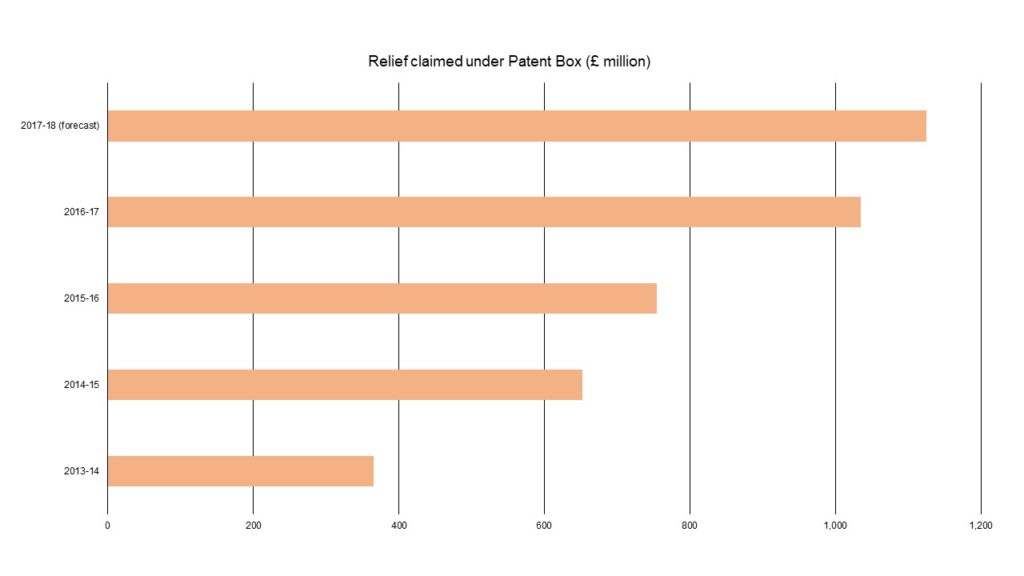

Under the rules of the Patent Box, companies are allowed to back-date their Patent Box claims by up to two financial years. This report by HMRC therefore includes a complete set of tax relief data only up to the 2016-2017 fiscal year, ending on 31 March 2017. The report also has a forecast for the 2017-2018 fiscal year, ending on 31 March 2018. This forecast includes claims already received from companies and an estimate for future claims, which is based on later claims received in previous years.

Key Points

The value of tax relief claimed under the Patent Box has increased year on year from 2013-2014 to 2015-2016 as the benefit of the Patent Box has been phased in, and this has continued in 2016-2017.

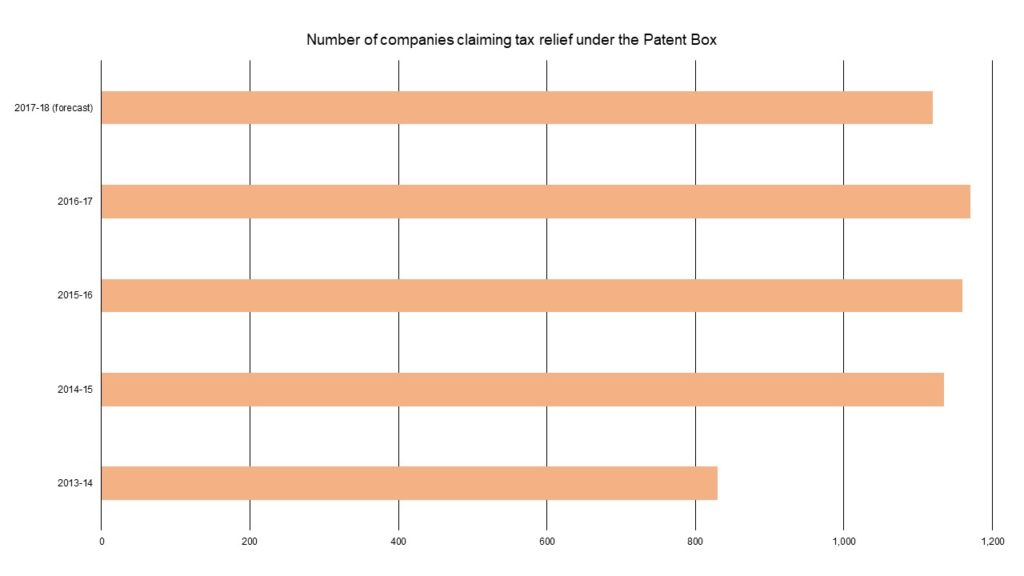

In 2016-17, 1,170 companies claimed relief under the Patent Box, and the total value of relief claimed was £1,035 million. This total value is expected to increase to around £1,125 million for 2017-2018.

31% of the companies that claimed tax relief under the Patent Box in 2016-2017 were classified as ‘Large’ under the EU’s company size definitions, but these companies accounted for the vast majority of tax relief claimed (95%).

55% of the companies that claimed tax relief under the Patent Box in 2016-2017 were in the manufacturing sector.

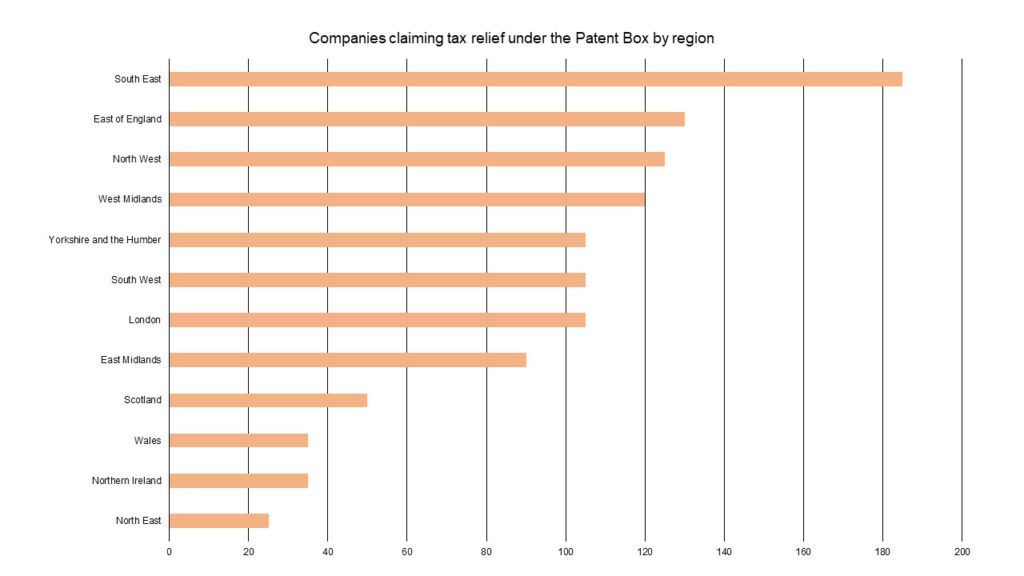

There is significant regional variation in companies claiming tax relief under the Patent Box. The highest number of companies claiming tax relief was in the South East of England (17%) and the lowest was in the North East of England (3%).

Companies in London claimed a significant amount (51%) of the total tax relief claimed under the Patent Box in 2016-2017.

Comments

It was predicted that the tax relief claimed under the Patent Box would hit £1.1 billion by 2019. This prediction appears to be on target, though the figures for 2017-2018 are only a forecast.

However, the Patent Box was not just implemented by the UK government to allow companies to reduce their tax bill. One of the key reasons for its creation was to make the UK a more attractive location to earn patent income and to encourage multinationals to invest in research and development in the UK, which would increase the overall tax base and potentially generate more tax revenue for the government. In this respect, it’s difficult to say that the Patent Box has been a success so far, but it is still early days and the uncertainty of Brexit has no doubt had an influence on any potential investment.

Therefore, in addition to the statistics on the uptake of the Patent Box, which only really show how much tax income has been lost due to the Patent Box, it would be useful to see data on investments that have been made in the UK specifically due to the favourable tax regime provided by the Patent Box.

Although the total tax relief claimed under the Patent Box keeps on climbing year on year, the number of companies claiming tax relief has stalled. It’s unclear why this is the case, but one reason that may be particularly affecting SME’s is that there is a serious amount of paperwork involved in capturing the information that is required to participate in the Patent Box. Another reason for the limited uptake is perhaps a lack of knowledge of the Patent Box, by companies, accountants and patent attorneys.

If you would like to learn more about how the Patent Box can improve your business, or for more information about intellectual property protection, please contact us on +44 (020) 7242 0901.

This article is for general information only. Its content is not a statement of the law on any subject and does not constitute advice. Please contact Reddie & Grose LLP for advice before taking any action in reliance on it.